What is Cost Segregation?

Whether you are building, remodeling, expanding, or purchasing a facility, a cost segregation study can help increase your cash flow. Many property owners do not take advantage of these provisions and end up paying federal and state income taxes sooner than they need to.

Cost segregation is a tax deferral strategy that frontloads depreciation deductions into the early years of ownership. Segregating the cost components of a building into the proper asset classifications and recovery periods for federal and state income tax purposes results in significantly shorter tax lives (5, 7, and 15-year) rather than the standard 27.5 year (for rental real estate) or 39 year (for most other types of real property) depreciation periods. Plus, with the current 100% bonus depreciation, even more can be frontloaded. In other words, you are able to defer taxes, putting more cash in your pocket to use or invest today.

What Are the Benefits?

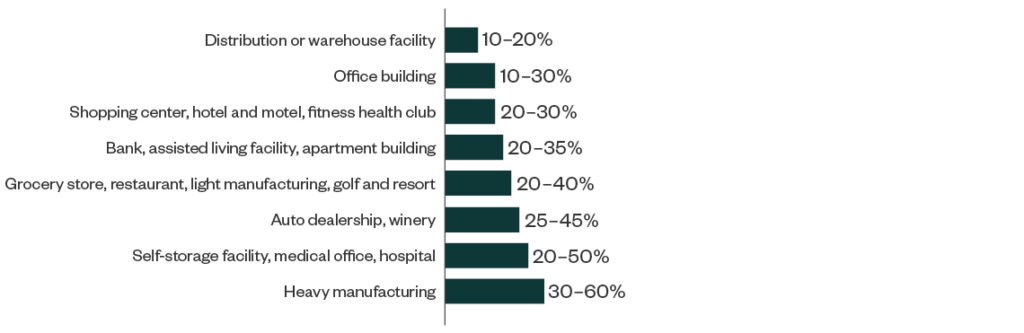

Let’s assume there is a newly constructed or purchased commercial facility. Typically, the facility’s property components and land improvements would be classified under “building” and depreciated over the standard 39-year period. A cost segregation study would identify items such as equipment, plumbing, electrical, furniture and fixtures that could be reclassified to shorter depreciable lives. As a general rule of thumb, the following estimated percentage of the price that can be written off immediately thought a cost segregation study:

Meaning, on average, if a new $1,000,000 apartment building is built, there should be at least $200,000 in additional tax deductions available to the owner(s), yielding about $70,000 additional cash in hand on an after tax basis; and these results scale up with larger properties. Of course, this will result in a slightly higher tax bill in the remaining tax life of the building, as cost segregation is only a strategy to defer taxes, but the time value of money in your hands today is significant.

What Type of Property Qualifies?

A cost segregation study may be performed for:

- New Construction

- Ground-up, remodel, or expansion

- Newly purchased property

- Leasehold improvements

AND

- The facility has a depreciable basis of at least $1,000,000 or leasehold improvements of greater than $300,000

- The facility or improvements have been placed in service any time since 1987

How is a cost segregation study performed?

First off, we will perform a risk free feasibility test in order to make sure that not only would your property qualify for such a study, but we will examine your tax returns and financial statements to ensure that it is feasible for you to have this study done, as there may be no sense creating deductions that cannot be taken advantage of. After this, we will sit down with you to offer our estimates at what kind of return you can expect, costs, and determine whether or not we want to proceed.

When available, an engineering-based cost segregation study in performed by looking at and comparing purchase invoices, construction blueprints, and/or physical inspections at site visits where a wide range of building components, such as electrical installations, plumbing, mechanical components, furniture, fixtures, and finishes can be identified and reclassified into shorter-lived asset classes.

When this information is not available, a Cost Segregation study can still be performed by carefully performing a detailed engineering cost estimate by estimating component values compared to market values and standard industry averages.

A Cost Segregation study can be completed any time after the construction, purchase, or remodel of a property; however, the optimum time for a study for new owners is during the year a building is constructed, purchased or remodeled as records are most readily available. Additionally, annual follow ups can be performed to ensure every deduction is captured when, for example, new fixtures are installed.

If the idea of a cost segregation study interests you, please contact attorney and CPA Ron Zmuda at rjzmuda@woodlamping.com or your Wood + Lamping attorney so that we can perform a feasibility test just for you.